The truckers did NOT lose in Canada. They WON. And so can we, however long it takes (if we don't let them panic-and-divide us)

Now we need to follow their example—and surpass it—to defeat CBDCs, and so much more that's in the works against us

“What people don't remember is what happened in the immediate aftermath: The government caved on absolutely everything within a week for the most important things, and then a month or so for the rest.”

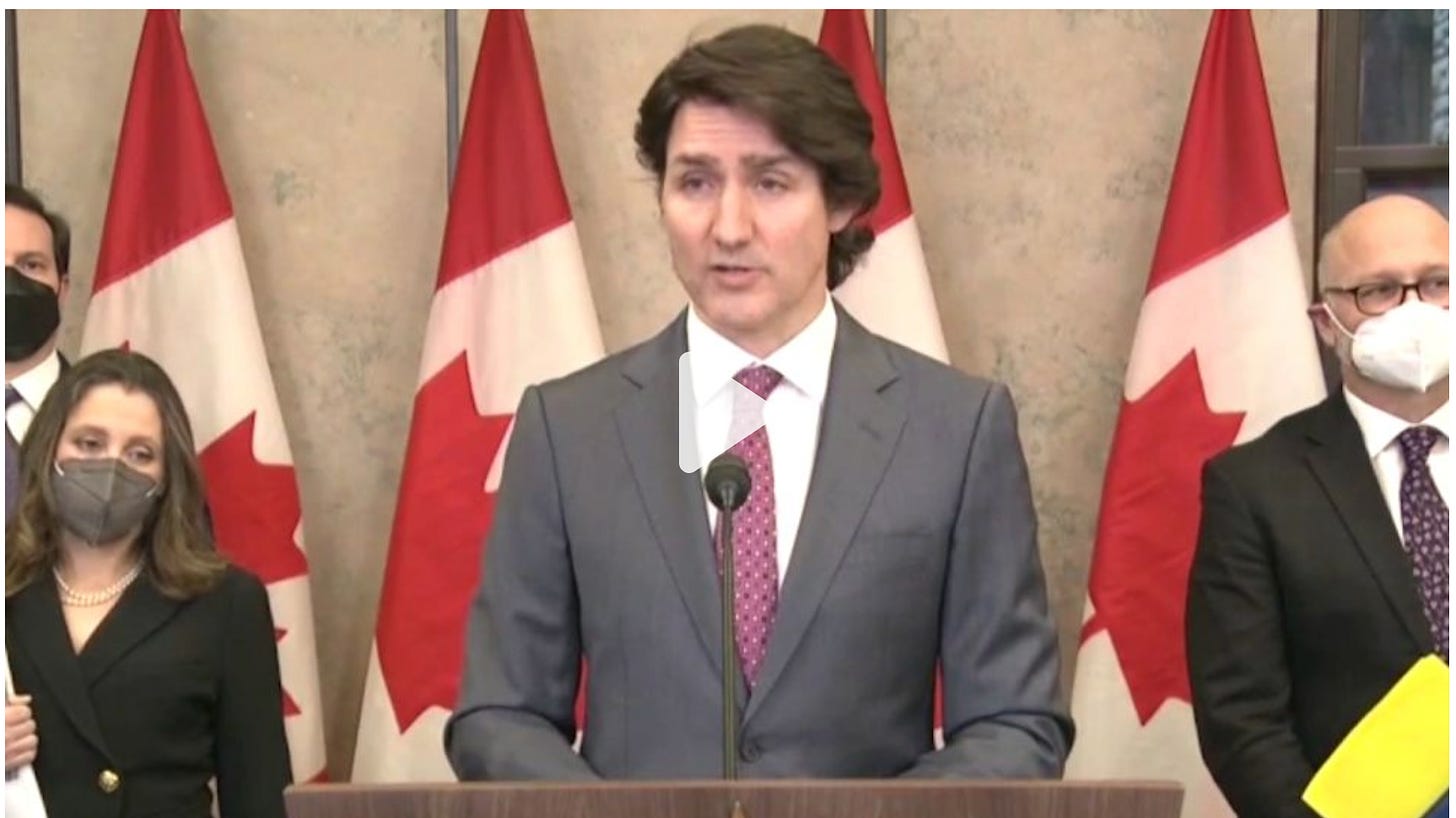

Thus Anarchonomicon observed, here on Substack, in a post that ran two months ago. (Thanks to Celia Farber for reposting it on 7/26.) In so doing, that reporter tells us, in detail, what “our free press” has wanted everybody not to know—which is, of course, why “people don’t remember” it, and why they see that winning protest as a noble effort that was variously smashed by the Trudeau regime (to fierce applause by the Canadian and US “left,” including Michael Moore, Naomi Klein and other New Authoritarians). According to this hopeless view, the convoy had no consequences other than a lot of state investigations of its criminality, and official affirmation of Trudeau’s fascistic steps to crush it—the point of all the media coverage since (search “truckers convoy Canada”), and one now certified, as usual, by Wikipedia:

https://en.wikipedia.org/wiki/Canada_convoy_protest

It should go without saying that that propaganda myth is a defeatist fantasy, devised to kill our fighting spirit. The fact is that resistance is not futile, but essential to the future of humanity; so we need not just to grasp how much those truckers actually accomplished, but to follow their example, now and through the trying times to come. (We certainly can stop CBDCs, as you will see below.)

The Truckers Won. Everything.

June 7, 2023

Resistance Isn’t Futile: The Global Rejection Of CBDCs

by Ari Patinkin and John Berlau

August 8, 2023

This insightful article only misses the key point that Central Banks are privately owned and not government institutions. There are only 214 central banks in the world, each serving only one client, that is, the host nation. The CBDC steamroller emanates from the central bank for central banks, the Bank for International Settlements in Basel, Switzerland.

Together, these Central Banks make up the giant vampire squid that is trying to take over the entire world and everything in it. These are the source of the WEF’s Great Reset, aka Technocracy. Deeply in debt to their central bank, nations now take marching orders from the central bank creditors, lest they be forced into bankruptcy and the seizure of their assets. ⁃ TN Editor

The Biden administration and the Federal Reserve are taking steps toward the potential roll-out of a central bank digital currency (CBDC). In attempting to do so, they are ignoring serious concerns about consumer privacy and heavy-handed government control in the U.S. and abroad.

Everywhere around the world, powerful heads of central banks and politicians are pushing central bank digital currency. Yet also around the globe – from the U.S. to Europe to Africa – more and more of the general populace are rejecting CBDCs as they learn what they would entail and experience them in practice.

A CBDC is a digital form of a national currency issued or coordinated by a nation’s central bank. Unlike paper or a private decentralized digital currency, a CBDC leaves an electronic trail of purchases and sales within a government digital ledger. Ledgers of such information are in the hands of governments that in many cases have a dark history of abuses of civil liberties.

Proponents say CBDC would lead to faster payments that would particularly benefit lower-income individuals. Yet critics argue the mechanism for CBDCs is ripe for abuse, allowing the government to violate financial privacy and reward and punish certain behaviors by controlling access to digital money.

Measures of public reaction in the U.S. and elsewhere show that the general public – as well as a growing number their representatives in their governments – are firmly on the side of critics of CBDCs. Americans are generally skeptical of grand new government initiatives. According to a recent Pew Research poll on faith in the American government, only 20 percent of the public currently trust the government.

Beyond general mistrust of government, Americans seem to specifically distrust the government wielding its powers with a CBDC. Most people don’t see a need for it, with just 16 percent supporting a Federal Reserve-controlled digital currency, according to a recent CATO Institute poll.

Europe is facing skepticism, as well. A growing number of members of the EU Parliament are saying they do not see any added benefit to a CBDC., Jack Schickler of CoinDesk reported in April. Markus Ferber, the economic spokesperson for the center-right European People’s Party, put it this way: “There’s one central question which hasn’t yet been credibly answered, which is what is the added value … what can I do with a digital euro that I can’t do with current payment options?”

Spanning the globe to Africa, an especially instructive lesson in the public’s reaction to the issuance of CBDC comes from that continent’s most populous country: Nigeria.

Nigeria rolled out its own CBDC, eNaira and, in the fall of 2021 and invalidated all paper banknotes, making the economy one of the first entirely cashless systems in the world. Nigerians were less than thrilled, as mass protests, boycotts, and utter rejection of the CBDC have ensued.

Even though the Nigerian Central Bank released huge incentives for citizens to adopt eNaira, according to Kunwar Khuldune Shahid of the Daily Dot, only 1.5 percent of the downloaded wallets were used once a week in 2022. According to Nicholas Anthony from the CATO Institute, the Nigerian government “removed access restrictions so that bank accounts were no longer required to use the CBDC. Then… offered discounts if people used the CBDC to pay for [taxi]cabs.” No offer has swayed the population to this day.

Nigeria’s political climate may be somewhat different from that of the U.S. and Europe, but the reasons for rejection of a CBDC carry some important similarities. A CBDC in which the government holds the ledger of the purchases and sales made with the electronic currency – whether issued by the Nigerian Central Bank or the U.S. Federal Reserve — would grant the government total surveillance power over individual transactions. If Nigerians buy and sell anything using eNaira, the digital ledger will show the government their purchases. A CBDC in the U.S. would likely work the same way

Given its poverty in comparison to the U.S. and Europe, the rejection of Nigeria’s citizens of a CBDC is a further blow to the dubious argument that issuance of CBDCs would somehow benefit the poor. Whatever benefits could be derived from the technology of the CBDC, Nigerians are concerned about their financial privacy and skeptical of government overseeing their purchases and sales. People worldwide agree that CBDCs greatly breach privacy regarding transactions between individuals.

In the U.S., lawmakers are introducing anti-CBDC legislation that should be a model for the world In the U.S. House of Representatives, Rep. Alex Mooney (R-WV) introduced the Digital Dollar Prevention Act in June, which prevents the Federal Reserve from committing to any programs involving the development of a CBDC without the express approval of Congress. While House Majority Whip Tom Emmer (R-MN) earlier introduced a bill restricting Fed issuance of CBDCs, Mooney’s bill takes it further, expressly banning “pilot programs” that could create CBDCs indirectly through public regulatory states and the private sector (which is Nigeria’s current currency distribution and maintenance method).

More must be done overall to protect civil liberties and the stability of the American free market from the destructiveness of a CBDC. We need bipartisan efforts to protect financial privacy and oppose policies that go beyond the wishes of the governed. As we have seen from the experience of Nigeria and prescient observations of ordinary Americans and Europeans, a central bank issuing a digital currency by the U.S. is unwise and would further erode existing financial freedoms.

Relatedly:

Fake meat sales plummet amid falling demand

August 10, 2023

https://frontline.news/post/fake-meat-sales-plummet-amid-falling-demand

I LOVE LOVE LOVE this article. As someone who lived in TORONTO from 1970-1993 it is SO EASY to think that Toronto is the voice of all of Canada. IT IS NOT. Their lopsided system of "democracy" gives Ontario (mostly Toronto) and Quebec all the power in the House of Commons, like almost 2/3s of the seats. The Canadian truckers, who bravely risked everything exposed the tyrannical TURDeau and now Canada is a laughing stock. And as this inspiring article points out the SMALL FRINGE MINORITY was almost everyone. And they won!

I blasted those trucker horns on my speakers, and caught flack from my double jabbed normie housemates. That's when I knew I was truly different from them; they had no idea what it meant. That both my parents were from Canada might have been a factor, eh?